"Family" includes grandparents and grandchildren in addition to the nuclear family. Department of Defense employees, contractors, retirees, and annuitants also qualify. armed forces - it's also open to families and household members. NFCU isn't only for those who are on active duty, retired, or veterans of any branch of the U.S. That said, many people are eligible for membership. Navy Federal Credit Union Mortgage does not make mortgage loans to the general public - you need to be a Navy Federal member. You can use Homebuyers Choice for a conforming loan or a jumbo loan. An additional one-time funding fee may be added to the loan balance, but the funding fee can be waived if you opt for a higher interest rate. This loan does not require a down payment or PMI. Navy Federal Credit Union Mortgage offers the Homebuyers Choice Loan to first-time home buyers. There is no down payment requirement and no private mortgage insurance. Navy Federal Credit Union Mortgage also offers the Military Choice loan to active duty or veteran borrowers who have already exhausted their VA loan benefits. Or you can eliminate the fee if you opt for a 0.25% interest rate increase. The 1% mortgage origination fee can be rolled into the loan so that you are responsible for less out-of-pocket closing costs. Navy Federal Credit Union Mortgage helps with closing costs in several ways. Navy Federal Credit Union Mortgage promises that if you find a better rate with another lender, it will match it or give you $1,000. A purchase contract is required, and limits apply. If rates go down, you can re-lock at the lower rate within 60 days. With the lock, if rates go up, yours stays the same.

#Navy fed auto loan calc free

Navy Federal Credit Union Mortgage offers a free rate lock (called Freedom Lock) for purchase and refinance applications.

What's more, Navy Federal Credit Union Mortgage charges less in mortgage points than some other lenders charge to get their advertised mortgage rate. When we checked, the fixed-rate conventional loan interest rate was the lowest we found. If you're rate shopping, prepare to be impressed.

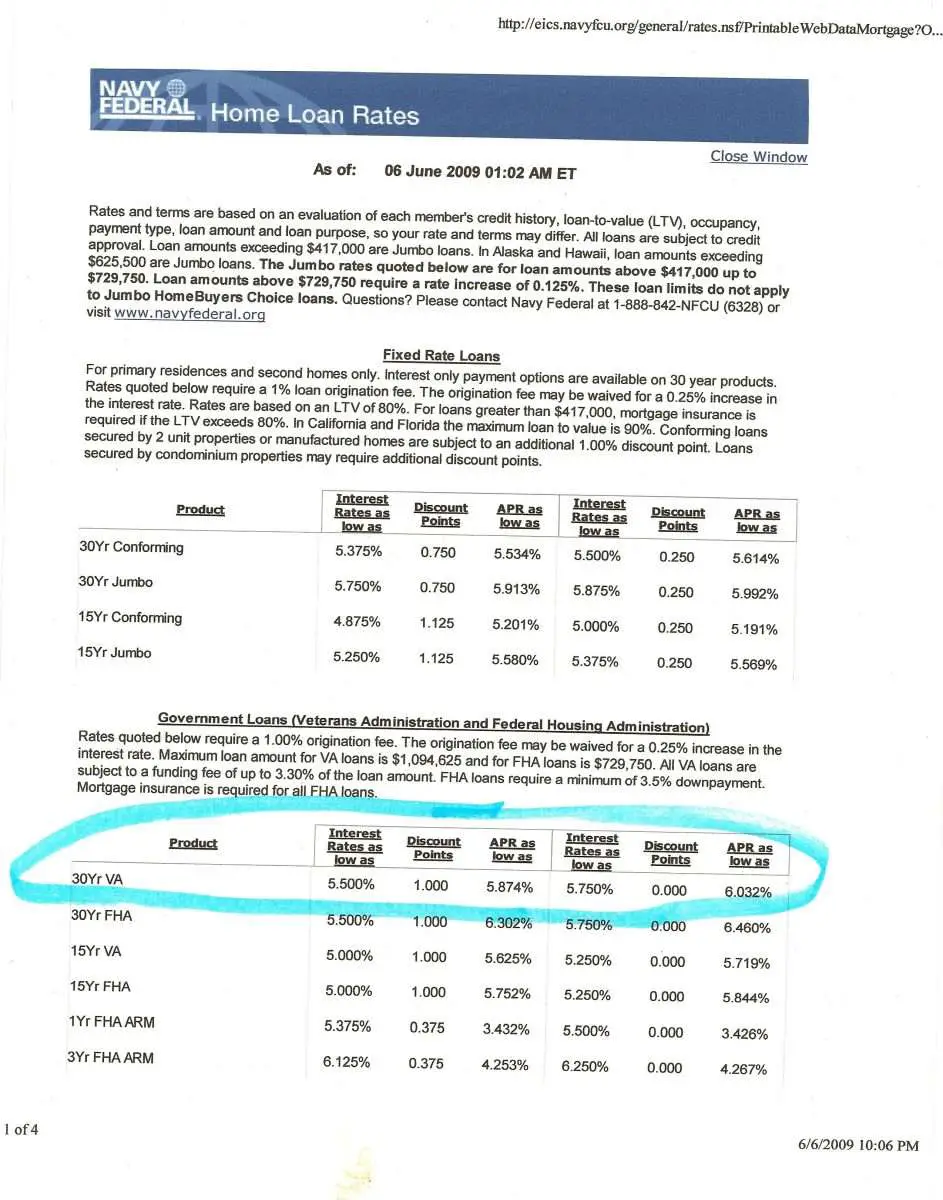

(Although it's important to remember not all applicants qualify for the best mortgage rate.) Super low mortgage interest rates That transparency can be very helpful for borrowers who are doing early research. Its detailed mortgage rate and fee sheet is public and extremely informative. NFCU shows its current mortgage loan rates on its website.

0 kommentar(er)

0 kommentar(er)